45l tax credit multifamily

Originally having expired at the end of 2021 recent legislation on the 45L Tax Credit has been retroactively extended for the. You are eligible for a property tax deduction or a property tax credit only if.

Section 45l Energy Tax Credit Renewed Retroactively Ascent Multifamily Accountingascent Multifamily Accounting

The 45L credit can have substantial value as demonstrated by these case studies.

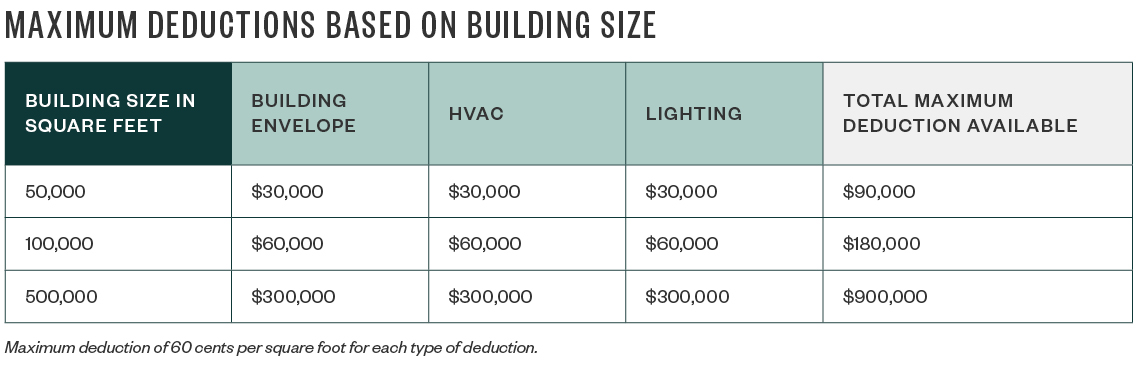

. 2000 per qualified home Single family and multi-family projects up to. For example a developer who builds a. For a developer of a low-rise multifamily development the credit applies to each qualifying unit initially leased or sold during the year.

Read customer reviews find best sellers. In general the Section 45L tax credit provides incentives for residential homebuilders and multifamily developers to reduce energy consumption in newly constructed. IRS Code Section 45L provides builders and developers with 2000.

To access your free listing please call 1833467-7270 to verify youre the business owner or authorized representative. The 45L tax credit incentives builders developers and contractors to design and construct energy-efficient homes. With CHEERS Energy Consultants and HERS Raters can now qualify additional dwelling units ADUs multi-family apartments and condominium projects for the 45L tax credit.

Browse reviews directions phone numbers and more info on Tax Credits LLC. Learn More at AARP. Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

Ad Enter Your Zip Code - Get Qualified Instantly. Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax. 45L is for residential and multi-family properties.

Free easy returns on millions of items. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home. Additionally this bill proposes a.

Three-story 83-unit multi-family project fully leased in the eligible. Free shipping on qualified orders. Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011.

Compared to single-family properties multifamily properties in. 45L is a federal tax credit for energy efficient new homes. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

What does the 45L Tax Credit extension mean. In todays real estate trend a multifamily property can play an essential role in affordable housing investments. The new 45L Tax Credit - if the bill passes - will go into effect retroactively allowing builders to claim the credit for all 2022 homes.

What is the 45L Tax Credit. Check Rebates Incentives. Check 2022 Top Rated Solar Incentives in New Jersey.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Ad Browse discover thousands of brands. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Enter Your Zip See If You Qualify. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a similar. The 45L tax credit is a home federal tax credit available to new construction multifamily and single-family projects that meet energy-efficiency.

The Proposed Build Back Better Act Makes Significant Changes To The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home

45l Tax Credit Extended For 2021 Homes Ducttesters Inc

Energy Efficient Tax Incentives For The Real Estate Industry

45l Tax Credit Source Advisors

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Taxconnections Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives

A Message For Earth Day Tax Credits That Work To Save The Environment

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Credits For Multifamily Dwellings 45l Tax Credit Engineered Tax Services

Section 45l Tax Credit Case Study Apollo Energies Inc

Tax Incentives For Energy Efficient Buildings

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

Biden S 2022 Tax Proposals Bolster The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

The Inflation Reduction Act Of 2022 Provides Significant Changes To The 45l Energy Efficient Home Credit Ics Tax Llc

The 179d 45l Energy Tax Credits Offer Cash Flow Elb Consulting